Lift importers have urged the government to reinstate lifts as capital machinery in the upcoming FY2025-26 budget to reduce duty burden, while local manufacturers oppose the move, citing unfair competition.

At a press conference in Dhaka on Wednesday, the Bangladesh Elevator, Escalators and Lift Importers Association (BEELIA) demanded that lifts be brought back under the capital machinery category, which would allow imports at a nominal 1% duty.

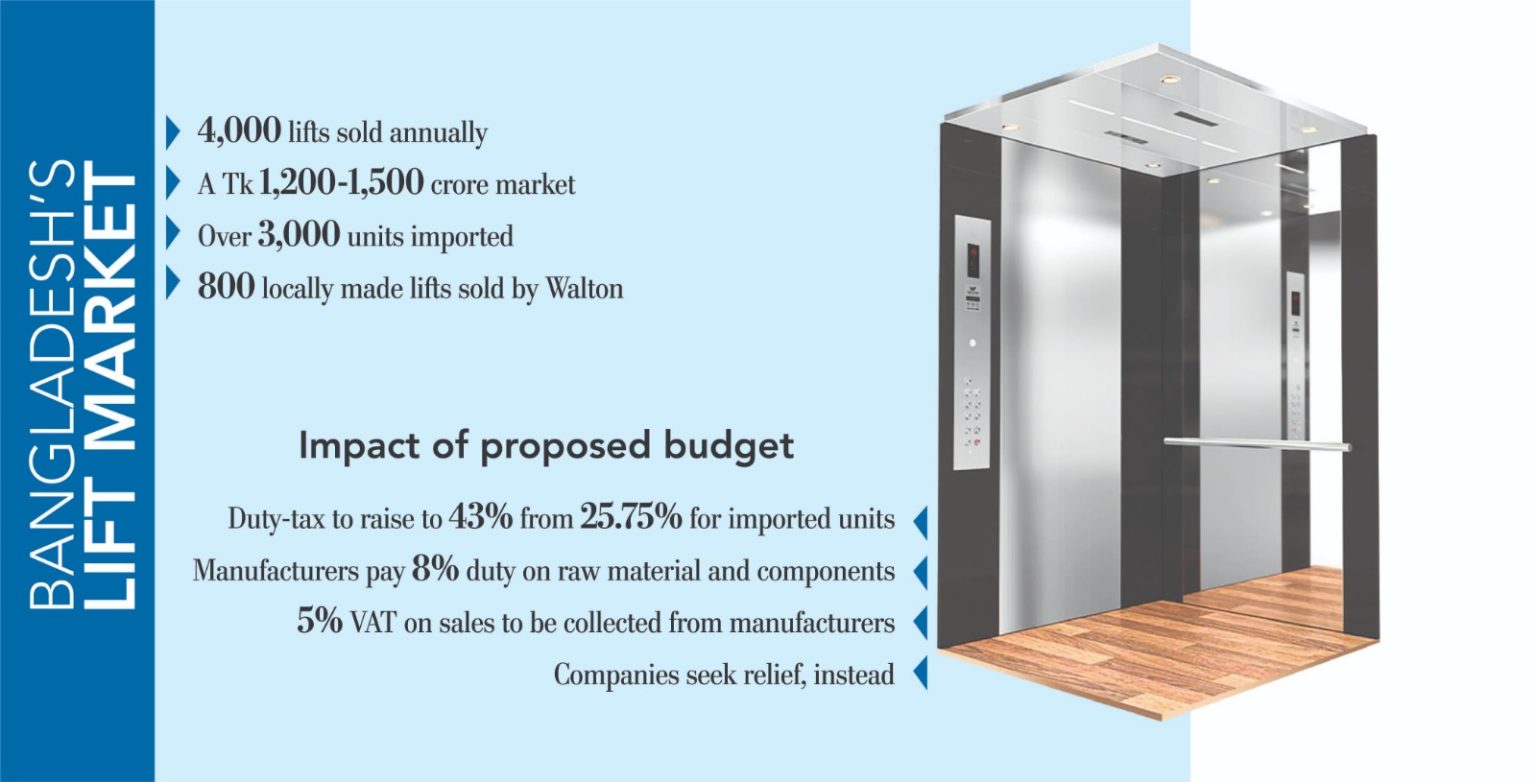

Currently, lift imports face a duty-tax burden of 25.75%, but the proposed budget would raise it to 43%, sparking concern among importers and consumers alike.

“Lifts are not luxury items”

“Lifts are essential building equipment, not luxury goods,” said BEELIA President Emdadur Rahman, “Treating them as commercial goods and imposing high duties is unjustified.”

Lifts were treated as capital machinery in Bangladesh until 2022, when they were reclassified as commercial goods, making them subject to significantly higher import duties, he said.

Rahman warned that the proposed tax hike would disrupt supply chains and increase prices for thousands of lifts currently in the import pipeline. He urged the government to maintain the existing duty-tax rates for lifts ordered before July 2025.

Concerns over tariff valuation

BEELIA leaders also criticized the National Board of Revenue’s (NBR) use of tariff value-based taxation, which imposes duties based on an artificially fixed minimum value of $3 per kg, regardless of the actual import price.

“About 65% of a lift consists of iron and steel, which cost less than $1 per kg in the global market. This inflated valuation results in unfairly high duties,” said a BEELIA representative. The association called for a rational revision of the tariff structure and VAT on spare parts to ensure affordability and safe maintenance.

Local manufacturers call for protection

Meanwhile, local manufacturers are pushing back against the importers’ demands. Companies like Walton, which has invested Tk250 crore in its lift manufacturing plant in Gazipur, argue that equalizing duty treatment would put domestic firms at a disadvantage.

“We are manufacturing European-standard lifts and selling them at 18%–20% lower prices than imported ones,” said Jenan Ul Islam, Chief Business Officer of Walton Lift.

“If lifts are again treated as capital machinery, importers will enjoy 1% duty while we continue paying 8% on raw materials and components—this will devastate the local industry.”

He argues that a supportive policy framework is essential as demand for lifts grows rapidly with urbanization.

Imported lifts still remained a preferred choice for many building owners as more than 3,000 lifts are imported a year, while the annual demand is around 4,000 now that created a Tk1,200-1,500 crore market.

BEELIA’s policy recommendations

BEELIA also presented a series of proposals to improve safety and regulation in the lift industry.

It includes reduction of the duties and VAT on lift spare parts to ensure safe and proper maintenance, establish Bangladesh’s own lift and escalator standards and safety codes, create a regulatory body to oversee lift supply, installation, maintenance, and safety.

They urge the government encourages both assembling and manufacturing of lifts in Bangladesh, given the limited availability of raw materials.

For a structured industry ecosystem, they seek introduction of a licensing system for companies involved in the lift business.

Their proposal includes introduction of lift and escalator technology in the educational curriculum to build skilled human resources alongside development of a government policy to nurture a competitive local lift industry capable of meeting domestic demand and eventually entering export markets.

They also urged the government to form a taskforce with all stakeholders to guide industry development.