The Dhaka Stock Exchange (DSE) wrapped up the week on a tepid note, as investor sentiment remained subdued due to lingering concerns over market momentum and global geopolitical tensions, particularly in the Middle East.

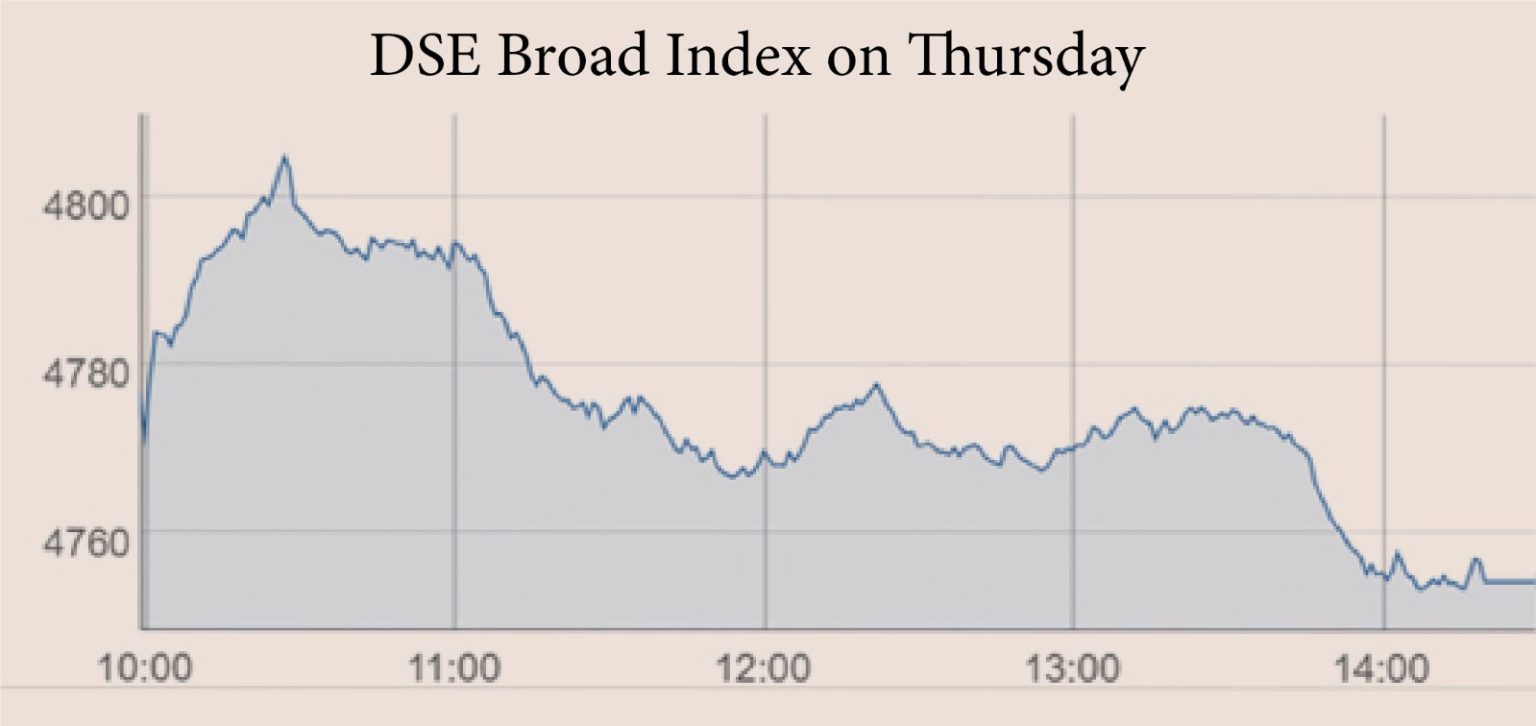

The benchmark DSEX index shed 22.4 points to close at 4,754, marking a 0.5% daily decline. Despite a brief rally in early trading, the market quickly turned bearish, pushing most stocks into negative territory. Out of 397 issues traded, 254 declined, 69 advanced, and 74 remained unchanged.

Daily turnover at the DSE dropped to Tk 3.05 billion, a notable decline from the previous session’s Tk 3.28 billion, reflecting investors’ risk-averse stance.

Sector-wise, Food & Allied stocks dominated the turnover, accounting for 16.8%, followed by Pharmaceuticals (13.5%) and Banking (12.1%). However, price corrections weighed heavily on several sectors, with Financial Institutions (-1.8%), Ceramics (-1.4%), and Life Insurance (-1.3%) suffering the steepest losses. Only the Telecom sector (+0.7%) managed to eke out modest gains.

Among the major gainers, Lovello Ice Cream, BRAC Bank, and Legacy Footwear posted significant advances, while laggards included GQ Ball Pen, Renwick Jajneswar, and Zaheen Spinning, which experienced sharp declines.

On the corporate front, British American Tobacco Bangladesh confirmed the closure of its Mohakhali factory and relocation of its head office to Ashulia, effective 1 July 2025, following a Supreme Court ruling.

Meanwhile, the Chittagong Stock Exchange (CSE) ended in positive territory, with the CSCX and CASPI indices rising by 6.4 points and 1.6 points respectively. CSE’s daily turnover, however, saw a dramatic decline of over 57%, settling at Tk 112 million.

Market analysts say the combination of weak macroeconomic cues, policy uncertainties, and lower-than-expected institutional participation continue to weigh on investor confidence.

With the fiscal year-end approaching and earnings season nearing, traders are expected to stay cautious until clear market direction emerges.