Bangladesh must strengthen its initial public offering (IPO) ecosystem to unlock sustainable economic growth, reduce dependency on banks, and expand formal employment, top investment bankers and capital market leaders said on Tuesday.

Speaking at a national dialogue titled “Expansion of the Capital Market: A Framework for Sustainable Economic Growth”, hosted by the Bangladesh Merchant Bankers Association (BMBA), stakeholders underscored the transformative impact of IPOs on company performance, government revenue, and financial market depth.

“IPO is not just about raising capital—it brings transparency, improves corporate governance, and integrates firms into the formal economy,” said BMBA President Mazeda Khatun. “It’s a gateway to growth—for companies and the country alike.”

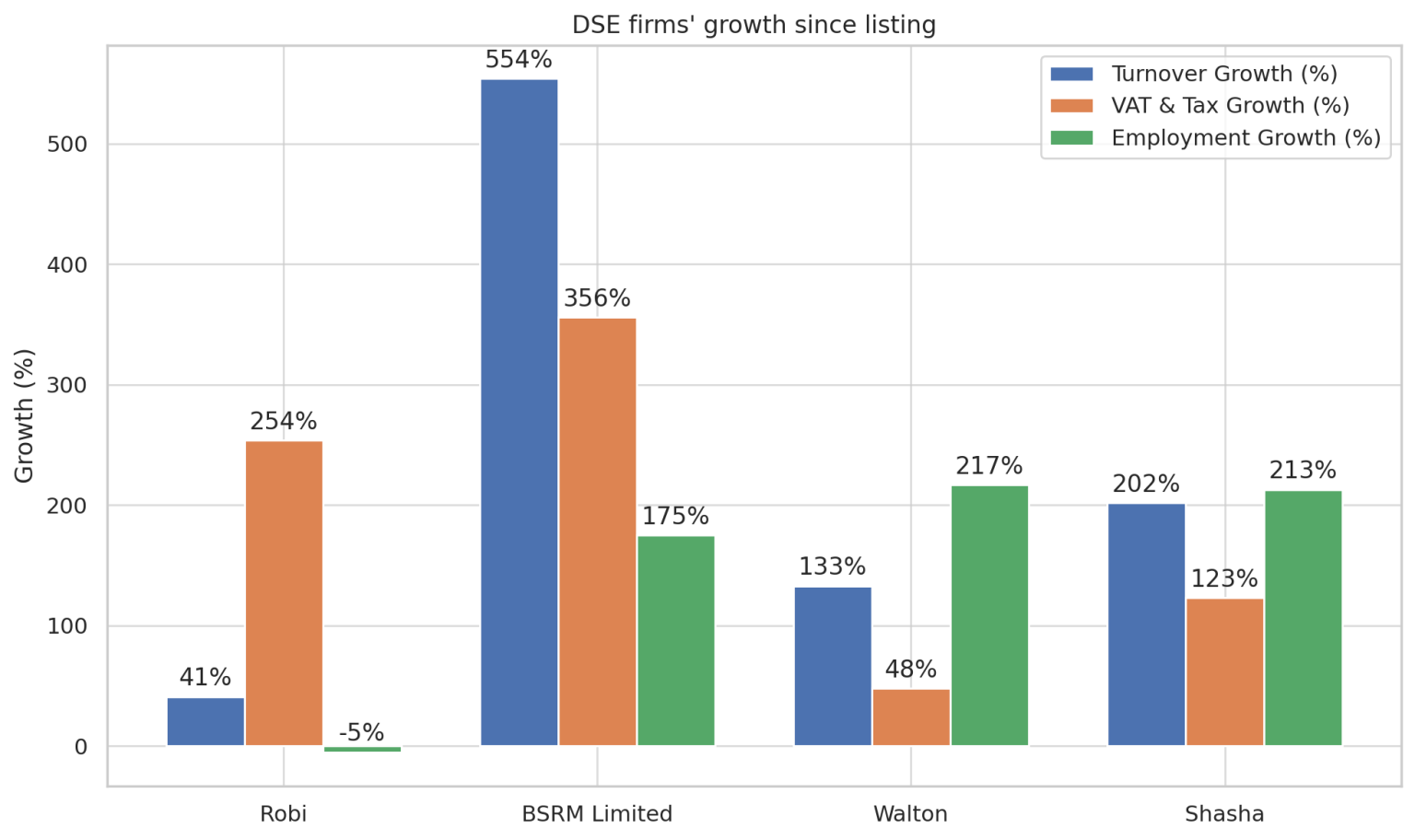

BMBA data presented at the event showed that 99 equity IPOs over the past decade generated an average return of 149% for primary investors within two years of listing. Firms such as Robi, Walton, BSRM, and Shasha Denims saw post-listing turnover surge by 40% to 550%, while their tax contributions rose between 48% and 356%. Walton’s employment alone increased by 217%, from under 10,000 to over 30,000 staff.

Mazeda argued that a more dynamic IPO market could yield macroeconomic dividends. “If ten firms with similar post-listing trajectories come to market, we could see an additional $4 billion in corporate turnover, $1 billion in revenue contributions, and up to 34,000 new jobs over the next decade,” she said.

Currently, Bangladesh’s capital market capitalisation stands at just 11.65% of GDP—far below that of India (118.89%), Malaysia (94.22%), and Thailand (82.49%), according to BMBA. Experts at the conference said this disconnect limits the country’s ability to fund long-term infrastructure and industrial expansion through non-bank finance.

Dhaka Stock Exchange (DSE) Chairman Dr Mominul Islam said delays in IPO processing remain a key hurdle. “We are working to reduce the IPO timeline to under six months. The stock exchanges are now empowered to handle listings, which should help streamline the process,” he said.

He acknowledged that no new IPOs were approved in the past year and challenged the performance of merchant banks. “Out of 66 licensed merchant banks, only 138 companies have been listed over 15 years. The problem is not regulatory—it’s institutional,” he said.

Apex Footwear Managing Director Syed Nasim Manzur said complex approval procedures deter high-quality firms from going public. “In India, IPOs take six months. Here it can drag on for years. That has to change if we want serious companies to consider listing,” he said.

The event was attended by Finance Adviser Dr Anisuzzaman Chowdhury as chief guest, with special remarks from ICB Managing Director Niranjan Chandra Debnath and Chittagong Stock Exchange Chairman Habibur Rahman.

Participants concluded that a vibrant IPO market is critical not only for capital mobilisation but also for enhancing investor confidence, expanding formal employment, and reducing the government’s reliance on debt.