A review team from the International Monetary Fund (IMF) has wrapped up its two-week mission to Dhaka without approving the release of the next tranches of its $4.7 billion loan package, raising fresh concerns about Bangladesh’s economic stability.

The cautious statement from the Washington-based lender signals that, while the South Asian country still has a chance to receive the much-needed funds, it must first meet pending reform conditions.

The IMF has already disbursed three installments —$476.2 million in February 2023, $681 million in December 2023, and $1.15 billion in June 2024.

However, over $1.3 billion remains pending under the Extended Credit Facility, Extended Fund Facility, and the Resilience and Sustainability Facility.

The interim government has also requested an additional $750 million augmentation to address rising fiscal stress, but delays in disbursement could severely impact the economy.

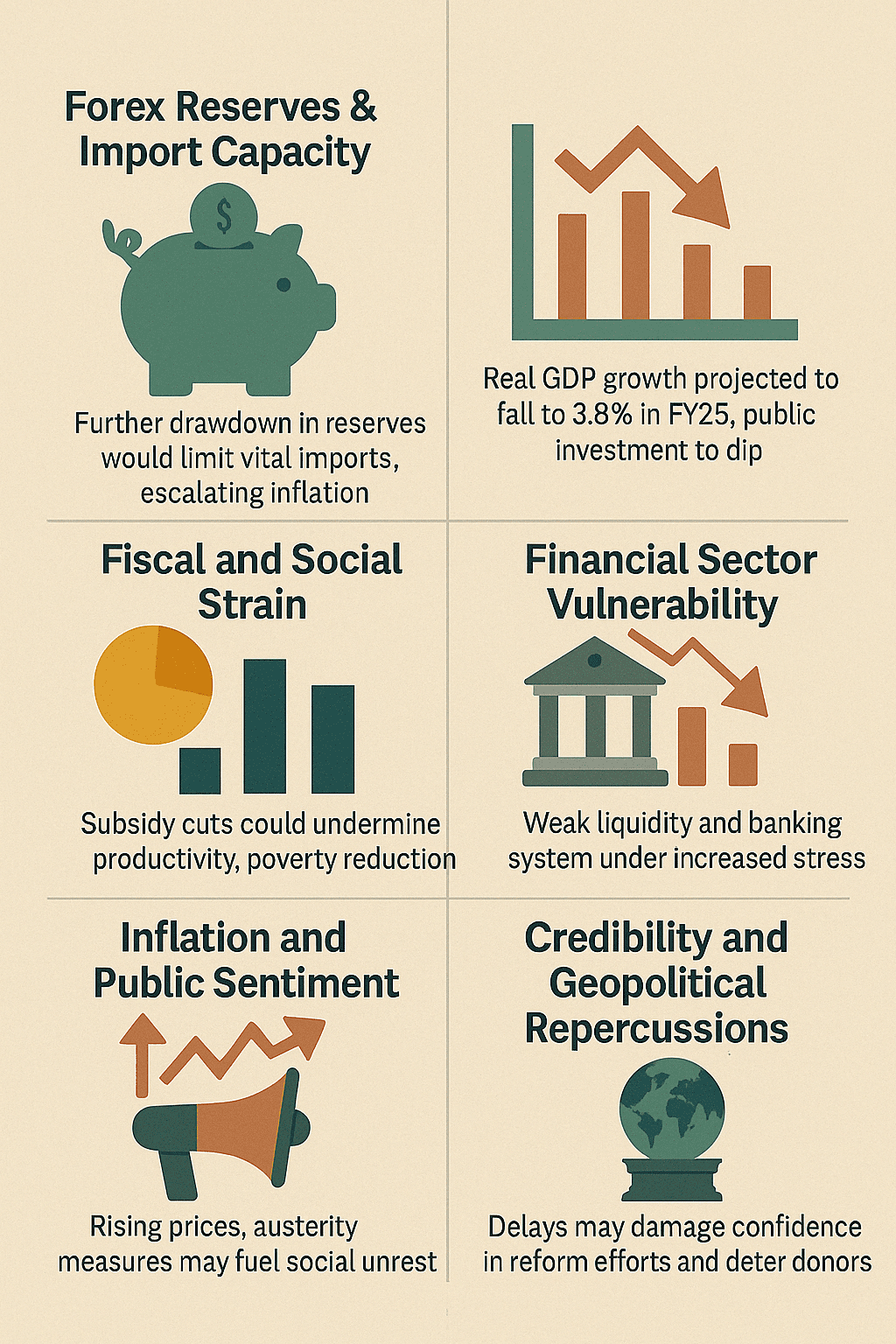

Bangladesh’s foreign exchange reserves are under immense pressure, driven by declining remittances, sluggish garment exports, and persistent capital outflows. With reserves already strained, any further delay in IMF support could worsen the country’s ability to finance imports of energy and essential commodities.

The economic slowdown adds to the urgency. Real GDP growth is projected to fall to 3.8% in FY25 from 6% in FY23, largely due to political unrest, recent floods, and tighter monetary policies.

Without timely support from the multilateral lender, critical government subsidies for electricity and fertilisers may be curtailed, undermining productivity in both agriculture and industry.

A shrinking fiscal space would also reduce public investment in infrastructure and climate resilience—key drivers of sustainable growth.

The financial sector, already weakened by high non-performing loans and governance issues in state-owned banks, faces increased stress. Capital outflows from banks in 2024 have worsened liquidity, and any delay in IMF funding could stall much-needed reforms, limiting credit availability and further straining the financial system.

Meanwhile, inflation—fuelled by surging energy and food prices—continues to squeeze household budgets. Social welfare programmes, essential for supporting low-income groups, are at risk of being slashed, potentially pushing more people into poverty.

With the government already grappling with post-flood recovery and costs related to political unrest, delayed IMF funds could trigger austerity measures, worsening public dissatisfaction and social instability.

Politically, the interim government, formed during a period of unrest, is under intense scrutiny. Delays in IMF disbursements may be perceived as a failure to meet reform commitments or secure international trust, damaging its credibility at home and abroad.

The administration’s initial request for $3 billion—later reduced to $750 million—has already raised concerns about strategic clarity and economic competence.

Internationally, failure to meet IMF benchmarks may deter other development partners, such as the Asian Development Bank or the Japan International Cooperation Agency.

Despite a 1,170% surge in foreign loan commitments in FY24, disbursements remain low due to poor implementation capacity—further complicated by IMF delays.

To address these challenges, the interim government must act swiftly. This includes transparent public communication, accelerating tax reforms to boost revenue without harming the poor, and seeking diversified funding through bilateral channels.

Otherwise, delays in IMF support risk deepening economic turmoil and eroding both public and international confidence.