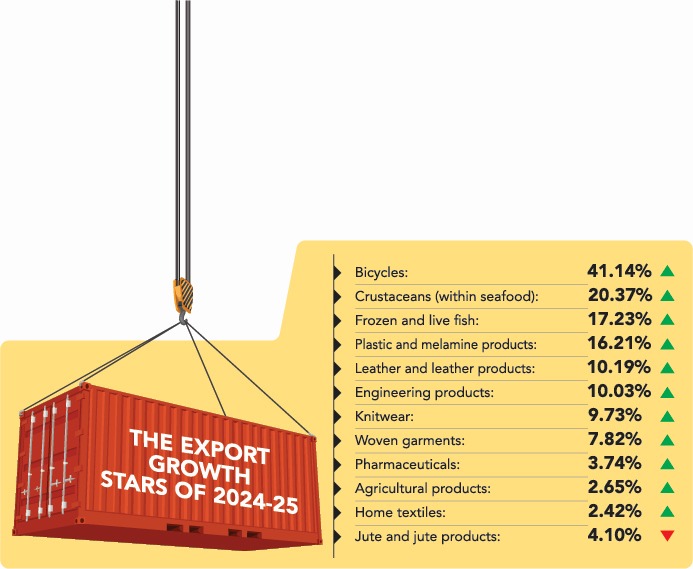

Bangladesh’s exports rose to $48.28 billion in the fiscal year 2024–25, an 8.58% increase from the previous year, propelled by strong performances in textiles, seafood, and bicycles, according to data released by the Export Promotion Bureau (EPB).

Knitwear and woven garments remained the backbone of the export economy, while non-traditional sectors like frozen seafood and bicycles recorded some of the highest year-on-year growth, signalling early signs of diversification.

Textiles remained the export mainstay

Garments once again dominated Bangladesh’s export basket. Knitwear earned $21.16 billion, up 9.73% from the previous year, while woven garments brought in $18.19 billion with 7.82% growth. Together, these two categories accounted for over 81% of total exports. Continued demand from the EU, US, and Canada helped sustain the upward trend, despite global economic uncertainties.

Seafood saw robust rebound

Frozen and live fish exports jumped 17.23% to $441.58 million, led by a 20.37% rise in crustacean exports. Shrimp and prawn shipments saw increased traction in China, Japan, and the Middle East as exporters benefited from improved processing and quality control.

Bicycles posted the highest growth rate

The bicycle industry posted a staggering 41.14% export growth, reaching $116.44 million compared to $82.5 million in FY2023–24. Bangladeshi bicycles, mainly destined for Europe, gained popularity due to competitive pricing and growing demand for eco-friendly transport solutions.

Leather and engineering sectors grew steadily

Leather and leather goods brought in $1.15 billion, a 10.19% increase, aided by modernised tanneries and a rebound in global orders. Engineering products also performed well, earning $535.56 million, up 10.03%, as demand rose for locally manufactured machinery, tools, and auto parts.

Plastics and pharma expanded footprint

Exports of plastic and melamine products rose 16.21% to $284.05 million, driven by increasing orders from the US and Africa. Pharmaceuticals brought in $213.16 million, growing 3.74%, with continued access to generic drug markets in Asia and Africa.

Agriculture grew, but jute declined

Agricultural exports rose 2.65% to $1.01 billion, backed by demand for vegetables, fruits, and spices. However, jute and jute products saw a 4.10% decline to $820.16 million due to weak demand in traditional markets and competition from synthetics.

Export outlook: Diversification gains traction

While textiles remained dominant, FY2024–25 marked significant gains in non-garment sectors like seafood, bicycles, and engineering products. Analysts say this trend indicates a slow but steady broadening of Bangladesh’s export base.

Policymakers now face the challenge of sustaining this diversification while strengthening traditional sectors, particularly in the face of new trade barriers in key markets.