Nvidia on Wednesday became the first publicly traded company to hit a $4 trillion market capitalisation, edging past Apple and Microsoft amid a sustained rally fueled by AI-driven optimism, reports CNN.

The US chipmaker’s stock rose as much as 2.76% during intraday trading, briefly pushing its valuation over the $4 trillion mark, before closing the day with a 1.8% gain, just under the threshold.

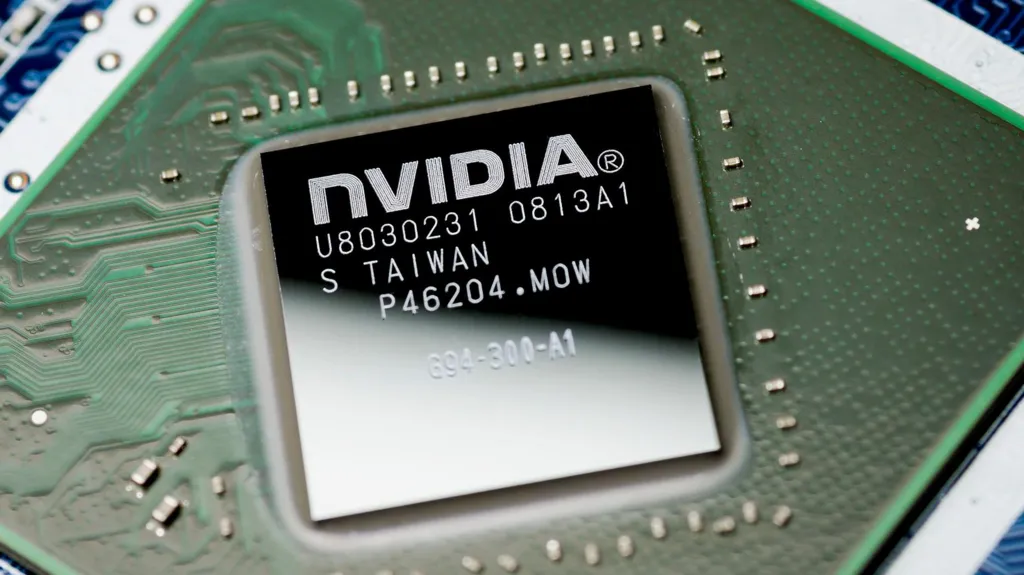

Nvidia’s meteoric rise comes amid booming demand for its high-performance chips that underpin artificial intelligence infrastructure for global tech giants including Microsoft, Amazon, and Google.

“There is one company in the world that is the foundation for the AI Revolution and that is Nvidia,” Wedbush Securities analyst Dan Ives wrote in a research note on June 27.

Once best known for its dominance in graphics processing for gamers, Nvidia is now powering ahead with next-generation AI models aimed at robotics, autonomous vehicles, and data centres.

Its quarterly revenue surged to $44.1 billion as of April, a 69% year-on-year increase as corporate and government investments in AI infrastructure accelerate worldwide.

Global spending on AI infrastructure is forecast to surpass $200 billion by 2028, according to the International Data Corporation.

Nvidia first hit a $1 trillion market value in May 2023 and has since advanced nearly 74% since April this year, rebounding from earlier fears triggered by low-cost competition and China export restrictions.

The company reportedly lost out on $2.5 billion in revenue in the April quarter due to US sanctions on AI chip exports to China, including its flagship H20 chip.

The January market panic also stemmed from DeepSeek, a Chinese startup whose powerful low-cost AI model raised concerns over Nvidia’s premium chip pricing.

Despite those headwinds, analysts remain bullish.

“While it may seem fantastic that Nvidia fundamentals can continue to amplify from current levels, we remind folks that Nvidia remains essentially a monopoly for critical tech in the AI sector,” analysts from Loop Capital wrote in a June note, projecting a $6 trillion valuation by 2028.

Nvidia’s recent success has catapulted its CEO Jensen Huang into the world’s richest ranks.

According to the Bloomberg Billionaires Index, Huang is now the 10th wealthiest individual globally, with a net worth of $140 billion.

He has also gained prominence in political circles, reportedly meeting US President Donald Trump and joining his delegation during a high-profile trip to Saudi Arabia in May.

Nvidia is also a core partner in Trump’s Project Stargate, a $500 billion AI infrastructure plan announced in January.

Apple, which entered the year as the world’s most valuable company with a $3.9 trillion market cap, has since slipped amid uncertainty triggered by Trump’s trade policy shifts.

Microsoft, hovering around $3.77 trillion, is also expected to cross the $4 trillion mark later this summer, according to Ives.

“This is a historical moment for Nvidia, the tech space flexing its muscles, and speaks to the AI Revolution hitting its next stage of growth,” Ives said in an emailed statement.

Huang believes the journey is just beginning.

“AI is this incredible technology that’s going to transform every industry, from software to healthcare, financial services, retail, transportation, and manufacturing,” he said on Nvidia’s May earnings call. “And we’re at the beginning of that.”