Business leaders and trade experts have renewed their calls for Bangladesh to delay its graduation from Least Developed Country (LDC) status by three to five years from the current schedule of 24 November 2026.

They argue that an immediate transition could lead to billions of dollars in economic losses due to export declines, higher medicine prices, and rising royalty costs, further eroding the country’s economic competitiveness and investor confidence.

“The business community supports the principle of graduation, but Bangladesh is not yet prepared to face the challenges that come with it,” said Mahbubur Rahman, president of the International Chamber of Commerce, Bangladesh (ICCB), at a seminar titled “Graduation from LDC: Some Options for Bangladesh” in Dhaka on Thursday.

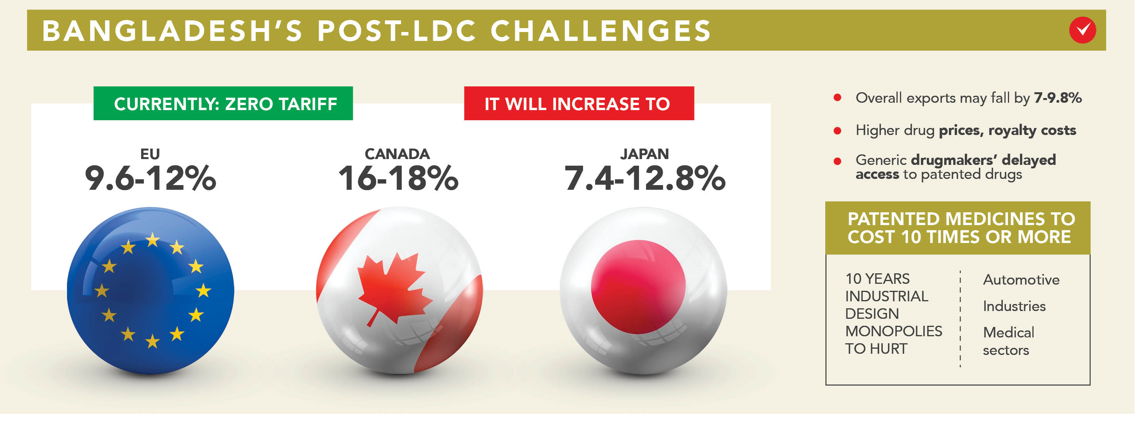

Currently, Bangladesh enjoys duty-free access to key markets other than the US, but post-graduation, tariffs could rise by 9-18% in these markets as the waivers are only for LDCs.

Calling immediate graduation “suicidal” for the economy, AK Azad, former Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) president and managing director of Ha-Meem Group, said, “Our economy is still fragile. Defaulted loans now stand at Tk 5.30 lakh crore, and about 1,200 factories are seeking loan rescheduling. Tariffs in Europe, Canada, and Japan will rise steeply. Foreign investment will not come if the ongoing gas and infrastructure problems persist.”

Trade implications of graduation

The challenges post-graduation could have far-reaching effects. Sanya Reid Smith, Legal Adviser and Researcher at the Third World Network, detailed the trade and intellectual property implications of graduation.

She explained that Bangladesh currently enjoys near-zero tariffs for 93% of its exports to the EU, which accounts for 48% of the country’s total exports. However, post-graduation, EU tariffs will increase to 9.6% under developing country preferences or 12% under the general rate from December 2029. This will severely affect Bangladesh’s apparel sector, which remains heavily dependent on exports to the EU.

Meanwhile, Vietnam will continue to enjoy zero-tariff access to the EU from 2027 under its free trade agreement, and India is expected to secure the same benefit by the end of this year, putting Bangladesh at a competitive disadvantage in the EU market.

Canada’s tariffs on most garments from Bangladesh could rise from zero to 16-18%, and Japan’s tariffs could increase from zero to 7.4-12.8%, worsening Bangladesh’s export prospects in these key markets. According to studies by the United Nations and other independent researchers, Bangladesh could see an overall export decline of 7-9.8% post-graduation.

Intellectual property and health concerns

Beyond trade, the challenges extend to intellectual property. Smith explained that under World Trade Organization Trade-Related Aspects of Intellectual Property Rights (TRIPS) rules, Bangladesh will have to grant 20-year patents on new medicines and 10-year monopolies on industrial designs.

This will delay the availability of affordable generic medicines, pushing prices up dramatically. For instance, insulin could become 11 times more expensive, and HIV treatments could rise over 200 times compared to generics, severely impacting public health and worsening poverty among affected households.

Moreover, Bangladesh’s annual royalty spending in the past decade has surged tenfold to around $900 million, and this figure could balloon after graduation due to new compliance with intellectual property rules.

Both Mahbubur Rahman and AK Azad emphasised that Bangladesh is not yet ready to face the post-graduation economic landscape. They pointed to economic fragility, lack of adequate infrastructure, and the gap in foreign investment as major reasons to delay the transition.

Rahman specifically called for better trade deals, industrial diversification, and a skilled workforce to mitigate the risks associated with graduation. He further stressed the need to strengthen Bangladesh’s institutional capacity to adapt to the economic changes that will follow. The business community has come together to demand urgent diplomatic action to secure a deferral, emphasising the need to safeguard preferential access to key export markets and bolster industrial capabilities.

Smith cited several countries that successfully negotiated delays in their LDC graduation. Maldives postponed its graduation by eight years, Vanuatu delayed it by 20 years, and Samoa and Equatorial Guinea extended their timelines by five years. Similarly, Nepal secured a five-year extension, while the Solomon Islands were granted a six-year delay.

Other countries like Tuvalu, Kiribati, and Myanmar have faced significant delays in their graduation process, with Tuvalu and Kiribati still awaiting rescheduled dates. While Bangladesh has already deferred its graduation from 2024 to 2026, Smith noted that further negotiations are possible. This would allow Bangladesh additional time to diversify its industries, markets, strengthen climate resilience, and enhance institutional capacity, ensuring a smoother and more sustainable transition.

While Bangladesh recently celebrated the reduction in US tariffs, business leaders have cautioned that this advantage may not be permanent. Syed Nasim Manzur, former president of the Metropolitan Chamber of Commerce and Industry (MCCI), described the celebrations as “premature.”

He pointed out, “It’s uncertain what tariff rates our competitors will face. This change might not hold if countries like India negotiate better terms.”

Although Bangladesh succeeded in reducing the US reciprocal tariff from 35% to 20%, aligning it with competitors like Vietnam and Pakistan, the formal agreement to finalise this change is still pending. Finance Adviser Salehuddin Ahmed confirmed that the deal has not been signed yet, adding a layer of uncertainty for exporters.

Taskeen Ahmed, president of the DCCI, echoed these concerns, stating, “There is nothing to be complacent about here, as negotiations are still ongoing. India might secure a reduced tariff in the future, potentially lowering it to 15% from the current 50%, making them more competitive than Bangladesh.”