Stocks have continued to slide despite a high-level meeting chaired by Chief Adviser Muhammad Yunus on May 11, where a set of strategic directives was issued to revitalise and modernise the country’s capital market.

The Dhaka Stock Exchange (DSE) benchmark index, DSEX, dropped for two consecutive sessions following a brief uptick on May 12, signalling that the chief adviser’s announcements have not yet restored investor confidence.

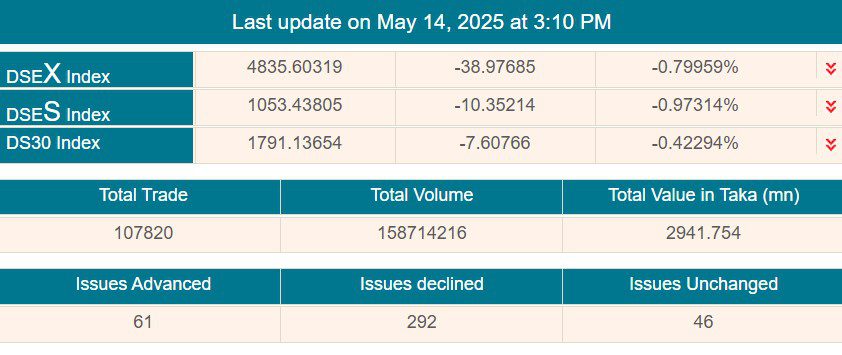

On Wednesday, the DSEX fell by 38 points, or 0.79%, closing at 4,835. Turnover also dropped by 14% to Tk294 crore. Of the traded stocks, 292 declined, only 61 advanced, and 46 remained unchanged.

The port city’s Chittagong Stock Exchange (CSE) mirrored the trend, with the CSCX index down 38 points to 8,322 and the CASPI shedding 71 points to settle at 13,614.

The downtrend began after a short-lived rally on Monday, the first trading day of the week, when the DSEX gained 19 points following the chief adviser’s meeting with regulators and financial officials.

The meeting was attended by Finance Adviser Salehuddin Ahmed, Bangladesh Securities and Exchange Commission (BSEC) Chairman Khondoker Rashed Maqsood, Financial Institutions Division Secretary Nazma Mobarek, and others.

Following the meeting, Chief Adviser Yunus issued five key directives aimed at restoring market stability and attracting new listings. These included offloading government stakes in profitable state-owned enterprises (SOEs) and multinational companies (MNCs), such as Unilever, on the stock market.

The BSEC was also instructed to develop incentives to encourage large private firms—such as City Group and Meghna Group, which each have annual turnovers of $2–3 billion—to enter the capital market.

In a bid to enact structural reforms, the chief adviser announced the formation of an independent team of foreign experts. Free from local vested interests, this team will be tasked with submitting actionable recommendations for capital market reform within three months.

“We’ve seen reform efforts blocked by powerful interest groups,” said Press Secretary Shafiqul Alam. “This independent panel will help bypass that resistance and restore trust.”

Yunus also called for curbing reliance on large syndicated loans and urged companies to raise funds through the capital market instead of excessive borrowing from banks.

He directed immediate action against entities involved in market manipulation, corruption, and irregularities.

Despite these moves, investors remain wary. On Tuesday, the DSEX fell sharply by 47 points to 4,875, reversing early gains as blue-chip stocks faced selling pressure.

The DSE Shariah Index (DSES) dropped 12 points, while the DS30—tracking blue-chip stocks—managed to gain 17 points, indicating sectoral imbalance.

Key stocks such as Square Pharmaceuticals, British American Tobacco Bangladesh, Grameenphone, Beximco Pharma, and Islami Bank led the decline.

Turnover fell to Tk344 crore, down from Tk364 crore in the previous session, reflecting waning investor participation.

According to insiders, long-term, transparent investors have largely exited the market, leaving behind short-term traders and suspected manipulators. Recent regulatory actions against manipulation have further subdued activity in both the primary and secondary markets.

“In the absence of confidence and liquidity, even fundamentally strong stocks are being sold off,” noted a market analyst. “Investors are looking for safer alternatives amid growing uncertainty.”

The stock market has been on a downward trajectory since August last year, when Rashed Maqsood took office as BSEC chairman under the interim government.

The DSEX, which was above 6,000 points at the time, has since dropped below 5,000, hitting a low of 4,802 on 7 May — the weakest since November 2020.

Frustration among general investors has intensified. Recent protests have called for Maqsood’s resignation, with critics questioning his understanding of market dynamics and his ability to restore investor trust. Some former BSEC chairmen and market veterans have echoed these sentiments.

Experts remain sceptical about the immediate impact of the chief adviser’s directives. Faruq Ahmad Siddiqi, former BSEC chairman, noted, “None of the announced measures are quickly implementable. Also, the meeting lacked voices from market intermediaries and stakeholders, offering only a partial view.”

DSE Brokers’ Association President Saiful Islam echoed this concern, expressing hope that the chief adviser would directly engage with market participants in future meetings to understand their challenges.

While the 11 May announcements have sparked conversation, they have yet to deliver the decisive boost the market urgently needs. Until investor confidence is genuinely restored and structural reforms begin to materialise, the outlook remains cautious.