Bangladesh’s macroeconomic environment is poised for inevitable monetary easing, which will lead to a decline in interest rates, according to Asif Khan, President of CFA Society Bangladesh.

In an interview with TIMES of Bangladesh, Khan, also the Chairman of EDGE Asset Management, explained his forecast.

“Monetary easing in near future is all but inevitable in the current economic setup, regardless of Bangladesh Bank’s potential actions. We are going to see a decline in nominal interest rates,” he said.

Khan identified two potential paths for monetary easing.

The First Path: Bangladesh Bank’s Intervention

The first scenario involves Bangladesh Bank purchasing US dollars from lenders to stabilize the exchange rate and maintain parity. This would inject more Bangladeshi Taka into the economy, increasing its supply.

“The increase in money supply would likely lead to a decline in yields on government bonds and treasury bills,” he explained.

He noted that Bangladesh Bank may try to neutralize the increased money supply by issuing bills, but such measures would only serve as temporary solutions.

“The net issuance of treasury securities is already set to plummet in August, according to Bangladesh Bank’s issuance plan. This could result in a sharp decline in yields,” Khan predicted.

“Already we have seen Bangladesh Bank purchase around $400mn in a week. That is a significant amount. “

The Second Path: Taka Appreciation

The second potential scenario is the continued appreciation of the Taka. While this may not significantly increase foreign exchange reserves, it would offer other economic benefits.

“Appreciation of the Taka will likely lead to a deflationary environment. For a country like Bangladesh, which heavily relies on imports, this will impact inflation,” he said.

Khan expects inflation to fall to around 5% by October 2025 without any taka appreciation, which could help stabilize the economy. Most of the predicted decline is due to base effects, as well as stable currency.

Real Yields and Investor Impact

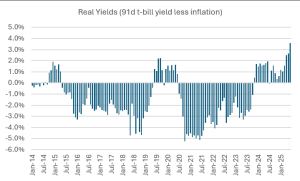

Currently, treasury yields range from 11% to 11.5%, and real yields have increased to around 4%. “This is unusually high, and the highest since 2012” Khan pointed out, indicating that bond yields will inevitably fall if inflation continues to decline as per expectation.

Real yield is the return on treasury securities or any investment after removing the impact of inflation.

He compared this situation to the previous period when raising interest rates in response to growing inflation was the obvious move. By the same logic, with inflation falling cutting rates would make proper sense.

Khan expressed full confidence in Bangladesh Bank’s ability to manage this transition.

“I believe Bangladesh Bank will do the right thing,” he said. “Regardless of the actions they take, we’re headed toward a period of monetary easing.”

A Path to Economic Growth and Stability

He emphasized the likely outcomes of monetary easing, including relief for borrowers, increased equity investments, and greater real economy investments.

“This easing will benefit both consumers and businesses,” he said. It will also benefit investors in the stock market and long term bonds.

However, Khan noted that political stability would be a key factor in sustaining long-term economic growth.

“The investments needed to drive growth and create jobs will depend on the political environment,” he cautioned.