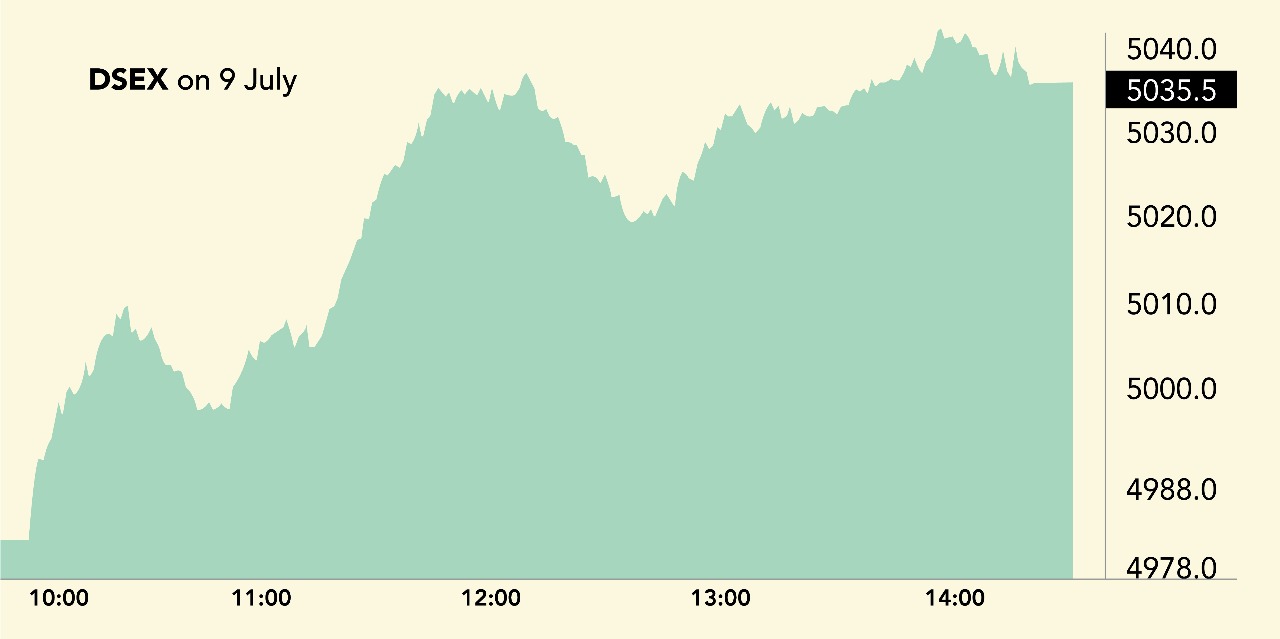

The benchmark index of the Dhaka Stock Exchange (DSE) surged past the psychological 5,000-point mark on Wednesday after two and a half months, as investor confidence remained strong amid improving macroeconomic indicators and upbeat expectations.

The broad-based DSEX rose by 53.83 points, or 1.1%, to close at 5,035.47, extending its rally for the sixth consecutive session. The blue-chip DS30 index added 18.82 points to settle at 1,894.21, while the Shariah-compliant DSES index advanced by 10.35 points to 1,094.11.

Turnover at the bourse rose sharply by 14.8% to Tk 690.62 crore — the highest in nearly eight months — with a total of 397 scrips traded involving 30.92 crore shares and mutual fund units. Out of these, 273 issues gained, 78 declined, and 46 remained unchanged.

Analysts said the market witnessed strong buy-side activity throughout the session, with investors taking fresh positions in anticipation of a sustained recovery. Despite concerns over the recently proposed 35% US tariff on Bangladeshi exports, market sentiment was buoyed by attractive valuations and a sense of resilience among retail and institutional investors.

Banking stocks dominated the turnover chart, accounting for 16.9% of total transactions, followed by pharmaceuticals (12.7%) and food sector (9.6%). On the sectoral performance front, life insurance led with a 4.3% gain, followed by ceramic (2.9%) and travel (2.8%).

Among the top turnover-generating companies were BRAC Bank, Beach Hatchery, Midland Bank, Bangladesh Shipping Corporation, Baraka Patenga Power, Taufika Foods, Orion Infusion, Sea Pearl Beach Resort, Indo-Bangla Pharmaceuticals, and Agni Systems.

Top gainers of the day included Rahim Textile, National Life Insurance, Sharp Industries, Shahjibazar Power, S. Alam Cold Rolled Steels, Exim Bank First Mutual Fund, Baraka Patenga Power, FAR Chemical, Doreen Power, and Green Delta Insurance.

On the flip side, the biggest losers were SEML Lecture Equity Management Fund, Yakin Polymer, Express Insurance, Desh Garments, BIFC, First Finance, Heidelberg Materials, FBFIF, Social Islami Bank, and Tosrifa Industries.

The upward momentum was mirrored in the Chittagong Stock Exchange, where both the CSCX and CASPI indices posted gains of 74.1 and 130.0 points respectively.