Dhaka’s stock market witnessed a steep fall on Sunday, 22 June, as growing geopolitical tensions rattled investor confidence and triggered a wave of sell-offs.

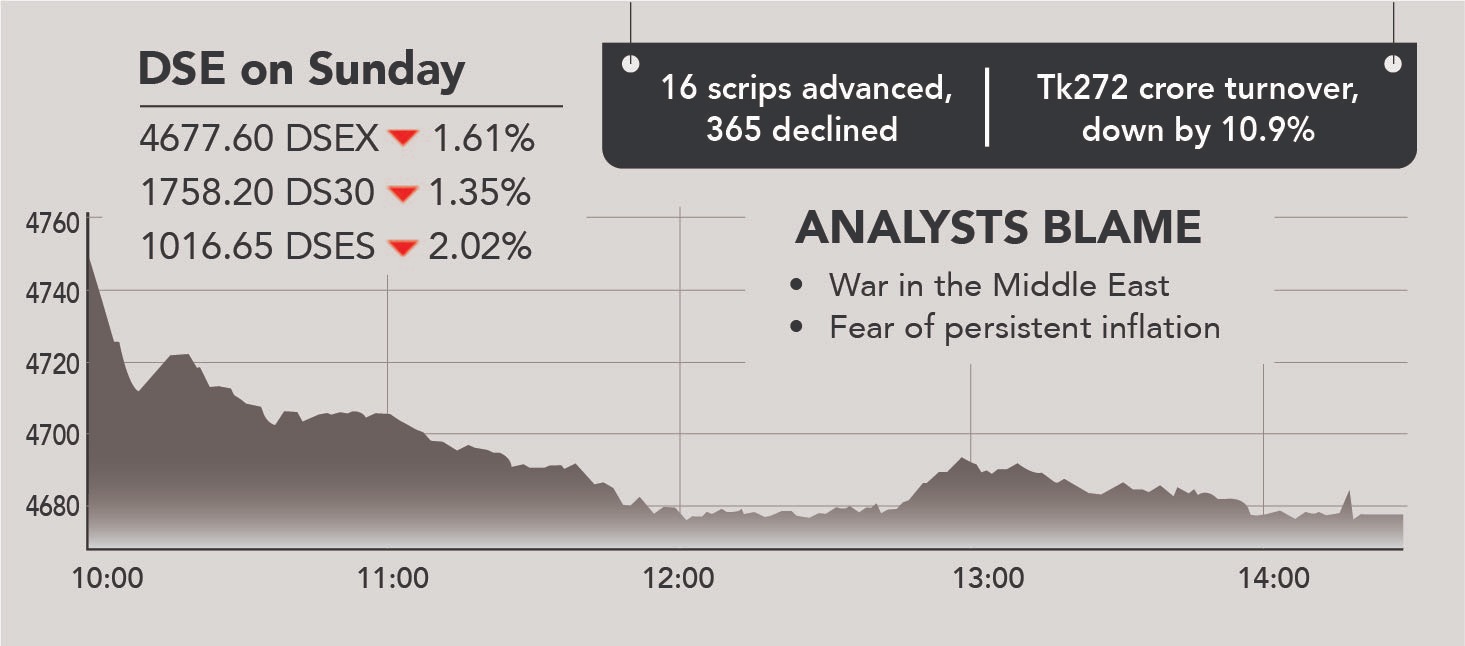

The benchmark DSEX index of the Dhaka Stock Exchange (DSE) plunged by 76.8 points or 1.6%, closing the day at 4,678, resuming the yearlong bearish run.

Analysts said that market participants were shaken by news of US airstrikes on Iran, which exacerbated global economic uncertainty and spurred widespread risk aversion.

Investors offloaded shares to mitigate further capital losses, resulting in a gloomy trading session. The downbeat sentiment prevailed across all indices, with the DS30 shedding 24 points (1.3%) and the SME index DSMEX dropping by 16.2 points (1.6%).

Turnover on the DSE slumped to Tk 2,71 crore from Tk 3,05 crore in the previous session, reflecting a 10.9% decline in market participation.

Despite the lower turnover, trade volume saw a slight uptick of 2% to 119 million shares, suggesting that smaller retail trades dominated the day’s transactions.

Of the 397 issues traded on the DSE, a mere 15 advanced while 363 declined and 19 remained unchanged.

The sharp sell-off was broad-based, with every sector finishing in the red. The most pronounced losses were seen in the Paper (-3.9%), Financial Institutions (-3.2%), and Ceramics (-3.1%) sectors.

Food and Allied stocks accounted for the largest share of turnover at 22.1%, followed by Banks (15.6%) and Pharmaceuticals (11.4%).

The port city bourse, Chittagong Stock Exchange (CSE), mirrored the capital’s bearish tone. The CSCX index dropped by 97.2 points (1.2%) while the CASPI lost 171.5 points (1.3%). Turnover, however, surged on the CSE, jumping 179% to Tk 31 crore, bolstered by block trades.

Year-to-date, the DSEX has now fallen 10.3%, and over the past 12 months, it has declined 10.9%.

Among the top turnover leaders were Lovello, Fine Foods, and Beach Hatchery though even these active scrips could not escape the market’s negative tide.

Stylecraft and Rahima Food posted modest gains of 4.9% and 3.7%, respectively, but were outliers in a predominantly declining market.

The price to earnings ratio of the market remained depressed, signalling reduced investor appetite and concerns about future earnings. Key blue-chip stocks like GP, Olympic, and Renata were among the biggest draggers on the index.

With global developments weighing heavily on investor sentiment and local fundamentals remaining tepid, analysts expect market volatility to persist unless there is a significant improvement in macroeconomic indicators or a de-escalation in global conflict.

Until then, the bearish undertone is likely to prevail, with cautious trading and low turnover continuing to define market activity.